Table of Contents

The Federal Budget, The Debt, and the Deficit

(Topics: The Economy | Back to Home)

What You Need To Know

Congress is the cause of and the solution to all of our challenges with the federal budget, the debt, and the deficit. What citizens need to know is this: in our country, Congress decides who can be taxed and how much, and Congress decides how much money to spend.

And if Congress needs to spend more money than it has, then Congress has to borrow it from somewhere.

(Who actually spends the money? Other parts of the government. But Congress is in control of the money.)

The Budget

That word is pretty easy to understand. It's the plan for where money is going to come from and how it will be spent. Most businesses have one and probably most families should have one too. Congress has a marvelously complicated and extremely important budgeting process that only nerds need to know about [1]. What citizens need to know is that Congress sucks at budgeting. [2]

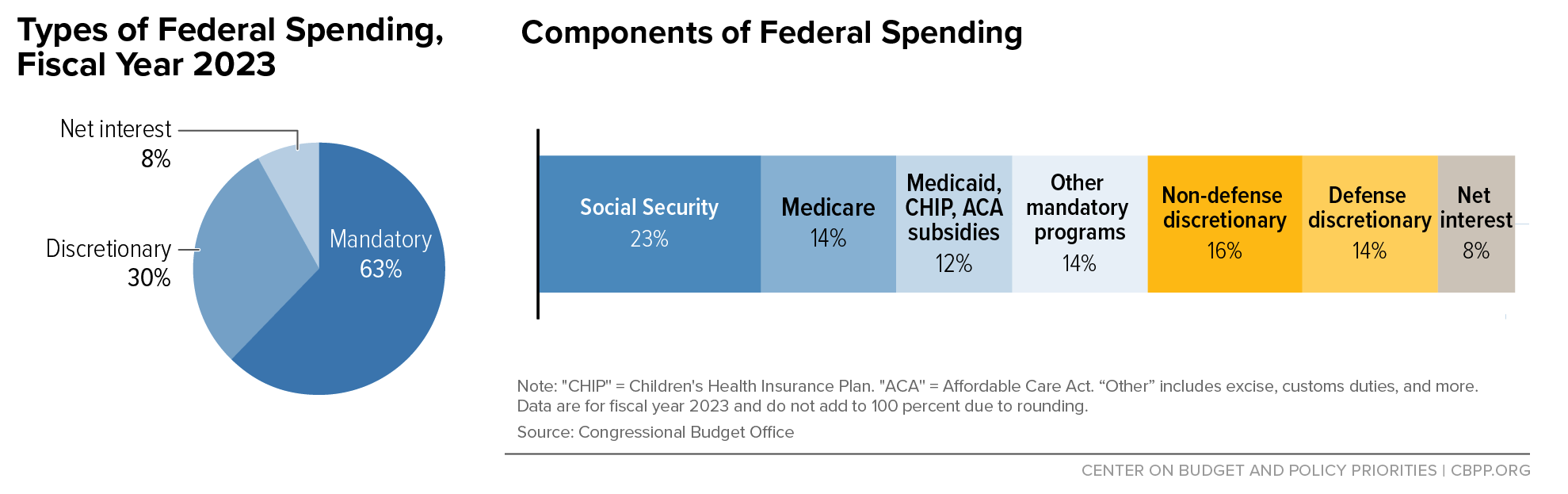

It's also worth knowing that we cannot radically change government spending without likely destroying the economy [3]. So here's where the money goes:

And the answer is to find ways to steadily spend less (maybe a few percent a year) so that the government needs less money and thus more money is the economy.

The Debt

I really do not like the phrase “the national debt.” The word debt implies money borrowed to buy something (like a house or a car) with a plan to repay the money in full, plus interest. But that's not how it works. Rather, the US government provides people and institutions the opportunity to buy a very safe investment. And then later, that investment pays off with a predictable rate of return. And it would be very, very bad if we “paid off” the national debt [4].

What we should worry about is the debt-to-GDP ratio. That is: how much we are using the federal treasury as an investment vehicle compared how well the economy is doing. And while single indicators don't say everything [5] this is a good one to consider:

The Deficit

The national debt is the total sum of the liabilities the Federal government has to pay out, someday, as part of the investment offering we make to individuals and institutions.

The deficit is how much the federal government is short on paying its bills for the current year based on the income (taxes) and expense.

The opposite of deficit is “surplus.” We haven't had a surplus since 2001.

See the problem?

[1] I say that, with all love, as a fellow nerd. Here's a great overview of the federal budget process. (I used some of their graphics in this piece.)

[2] Congress hasn't met its own deadline in 27 years and pretty much never in the last 50 years, The spring 2024 budget news was of course predicted and was a mess back in 1984 (read that article to see how little has changed, it even contains comments about “the oldest president to have ever served, prompting questions in the media about his capacity to continue.”) Also NPR explains the stupid politics of the budget and the left-leaning Brookings Institution and I could go on but I think I've made my point.

[3] For example, if we ended social security payments it would save 205 of the entire federal budget and be really ugly for seniors and the economy for a long while.

[4] NPR covers this well and famous economists say the same as well as not famous economists but you don't have to have a PhD to understand this. The way the government creates stability in the financial markets by selling fixed securities like treasury bills. You can always buy T-bills and be guaranteed a defined, modest return. They make up the largest chunk of the bond market, and the bond market is nearly three times the size of the stock market. So if there's no base market stability due to ongoing investment in treasuries, everything crumbles.

[5] A blog post of mine and even a whole presentation about it.